kansas inheritance tax rules

Create a revocable living trust. Kansas real estate cannot be transferred with clear title after the death of an owner or co.

We Solve Tax Problems Debt Relief Programs Tax Debt Irs Taxes

Like most states Kansas has a progressive income tax with tax rates ranging from 310 to 570.

. Kansas residents who inherit assets from Kansas estates do not pay an inheritance tax on those inheritances. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. The personal estate tax exemption.

Beneficiaries are responsible for paying the inheritance tax on what they inherit. Open bank accounts and designate heirs as beneficiaries of the accounts. If there is no will.

There is no federal inheritance tax but there is a federal estate tax. Kansas Probate and Estate Tax Laws. The state sales tax rate is 65.

Related Resources The probate process can be confusing. Even though Kansas does not collect an inheritance tax however you could end up paying inheritance tax to another state. As a general rule only estates larger than 534 million have to pay federal estate taxes.

The Kansas inheritance tax is based on the value of the assets received by the heir and the heirs degree of kinship to the deceased. On the other hand let us consider new jersey for our garden state subscribers. Add a transfer on death deed to any real estate you own.

The advantages of an inheritance cash advance in Kansas include. Kansas has no inheritance tax either. The inheritance tax applies to money or assets after they are already passed on to a persons heirs.

Hire a good estate planning attorney. In What Circumstances Does an Estate Have to Pay an Estate Tax. The first 534 million is exempted from taxes.

Assessment of the propertys value is done after a person dies to check if 534 million tax free limit is exceeded. The personal estate tax exemption. Kansas law provides several protections for surviving spouses.

To inherit under Kansas intestate succession statutes a person must outlive you by 120 hours. The state sales tax on groceries is reduced to 4. Information You And Your Lawyer Could use For A Solid Trust.

Kansas statutes dont provide a dollar amount or percentage of the estate that may be given as payment to the executor or administrator. The personal estate tax exemption. The federal estate tax is calculated and paid before the estate is distributed to the decedents heirs.

We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax. In Kansas the elective share is based on the length of the marriage. The estate tax is not to be confused with the inheritance tax which is a different tax.

However it does address the issue of compensation. If the will stipulates an amount to pay the executor that amount is to be considered the total sum of payment the person receives. By failing to plan properly.

Kansas Inheritance Laws Probate Process. Kansas does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax. However the Kansas Inheritance Tax may be payable even though no federal estate tax is due.

The estate tax is not to be confused with the inheritance tax which is a different tax. However the federal estate tax exemption was recently raised to a threshold of 112 million for an individual and double this amount for a couple. Kansas Sales Tax.

Up to 25 cash back Here are a few other things to know about Kansas intestacy laws. For example Kansas estate. As a result wealthy entrepreneurs may pass along far more in their estates.

So if you and your brother are in a car accident and he dies a few hours after you do his estate would not receive any of your property. If you live in Kansas and you inherit from a decedent in a different state you may be responsible for paying inheritance tax on it. Kansas real estate cannot be transferred with clear title after the death of an owner or co-owner without obtaining a Kansas Inheritance tax Waiver.

Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. Localities can add as much as 4 and the average combined rate is 87 according to the Tax Foundation. The minimum elective share is 50000.

Make sure any real property is. Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9. Kansas Inheritance and Gift Tax.

Otherwise a spouse is entitled to 3 percent of the estate for every year of marriage from one to 10 years -- for example 6 percent for a two-year marriage or. Kansas has no inheritance tax either. The Waiver is filed with the Register of Deeds in the county in which the property is located.

In 2019 that is 11400000. Once the probate case is opened in Kansas the executor is responsible for a number of duties.

Kansas Inheritance Laws What You Should Know

Kansas City Power Of Attorney Lawyers Top Attorneys In Kansas City Ks

Does Kansas Charge An Inheritance Tax

An Overview Of Kansas Divorce Laws 2022 Guide Survive Divorce

Kansas Estate Tax Everything You Need To Know Smartasset

Estate Tax And Inheritance Tax In Kansas Estate Planning

How New Kansas Laws Affect What You Pay In Property Taxes

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Tax Consequences When Selling A House I Inherited In Wichita Kansas Home Guys

Kansas Inheritance Laws What You Should Know

Estate Tax And Inheritance Tax In Kansas Estate Planning

Kansas Estate Tax Everything You Need To Know Smartasset

Kansas Gift Tax How 99 Can Legally Avoid Top Strategies

Are You Going To Invest In Real Estate Worry About Indian Property Tax Laws Then Read Our Blog Https Goo Gl Ks Estate Tax Property Tax Real Estate Investing

Kansas Gift Tax How 99 Can Legally Avoid Top Strategies

Kansas Inheritance Laws What You Should Know

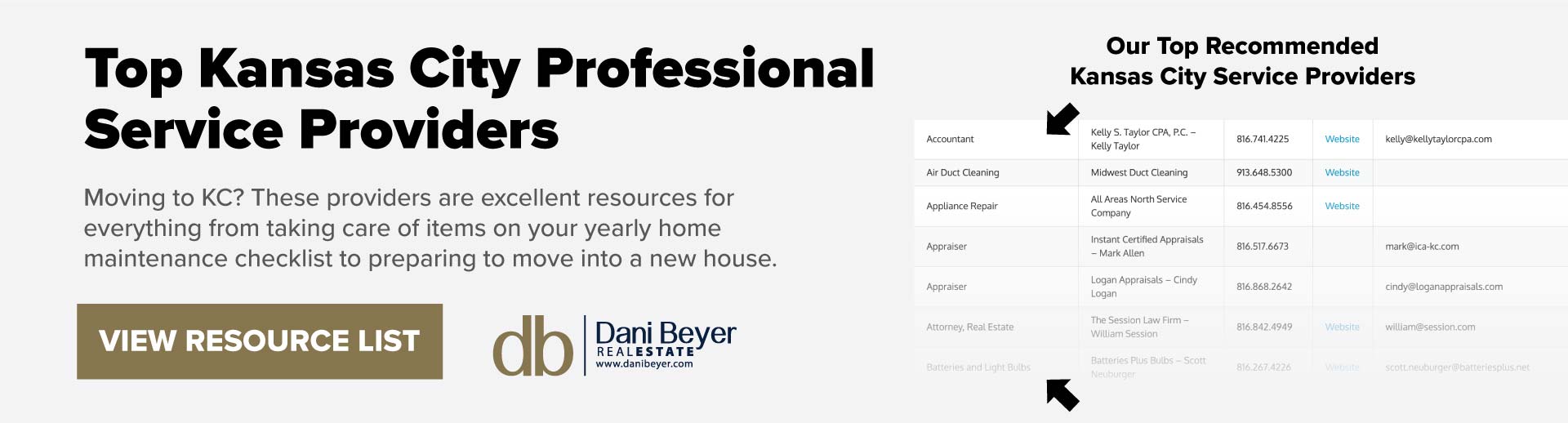

Which One Is Better To Live In Missouri Or Kansas Dani Beyer Real Estate